Don’t Accept What the Other Party’s Insurer Offers You

Kerr & Sheldon Diminished Value & Loss of Use Vehicle Recoveries

We successfully resolved the following clients’ Diminished Value (DV) & Loss of Use (LOU) cases for their luxury/exotic cars damaged in car accidents:

| Luxury/Exotic Cars |

Ins Carrier |

DV Recoveries |

| 2015 Ferrari 458 Italia |

AAA |

$80,000 |

| 2020 Ferrari 488 Pista 2D Coupe |

RLI Insurance Co. |

$120,000 |

| 2015 Ferrari 458 Italia |

AAA |

$153,837 |

| 2024 2012 Ferrari 458 Italia |

Progressive |

$100,000* |

| 2014 Rolls Royce Wraith |

GEICO |

$65,000* |

| 2017 Porsche Macan S |

Allstate |

$90,000* |

| 2014 Lamborghini Aventador |

Mercury |

$74,899* |

| 2018 McLaren 570 Spider |

GEICO |

$100,000* |

| 2018 Mercedes AMG GT C |

Progressive |

$78,145 |

| 2017 Porsche 911 Turbo S |

Farmers |

$87,350* |

Recovering Diminished Value and Loss of Use for Your Vehicle

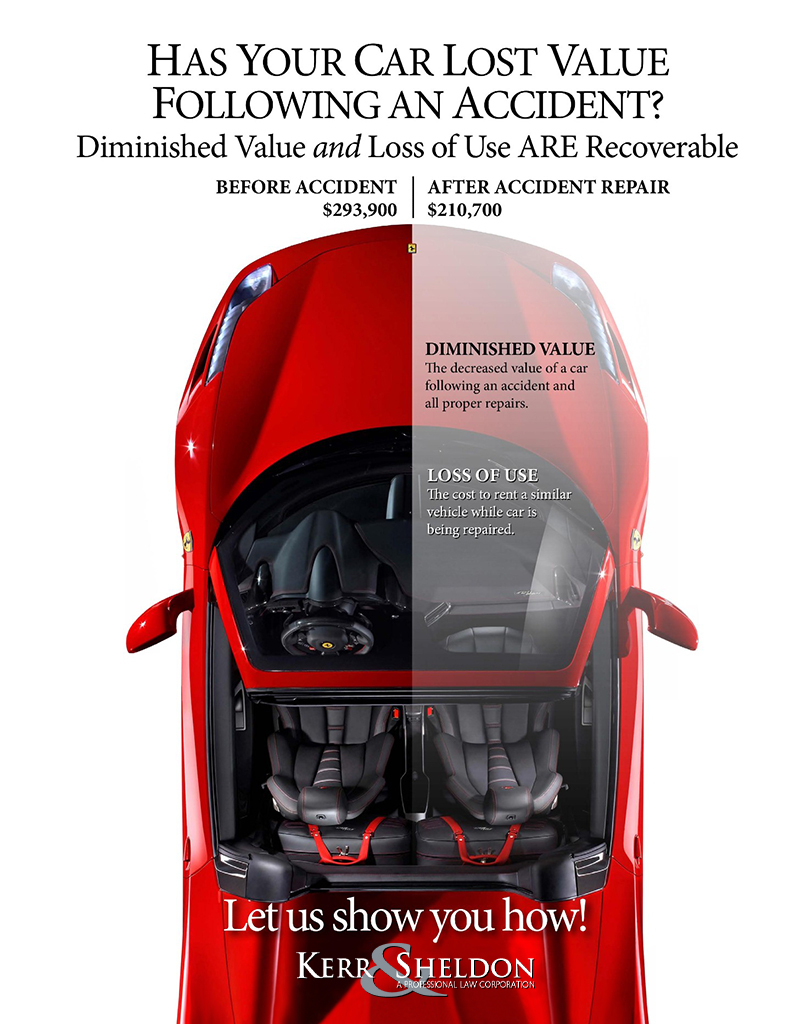

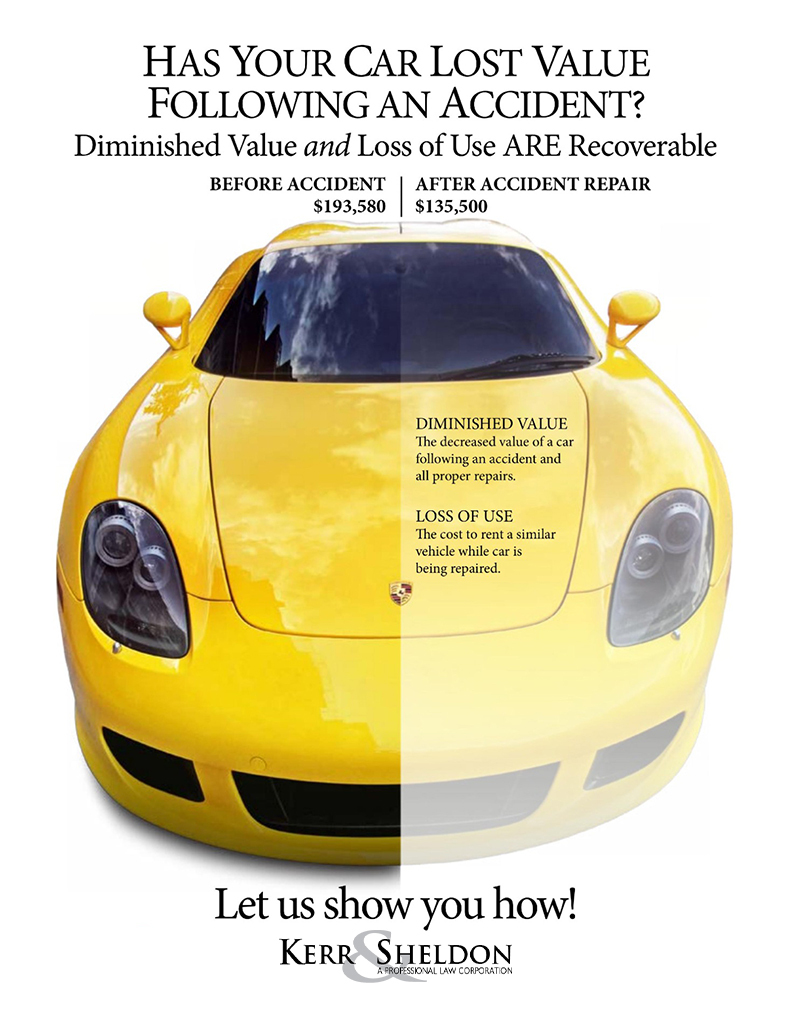

Every car buyer understands a vehicle’s accident history can substantially reduce its value. Even if a car seems mechanically sound and cosmetically clean, the car’s accident history significantly decreases its market value. If your vehicle is damaged in a collision due to someone else’s negligence, you’re entitled to recover more than repair costs. You’re also entitled to recover for the ‘diminished value’ and ‘loss of use’ of your vehicle from being damaged and repaired.

Diminished Value is the difference between the market value of a car prior to a collision and its reduced value immediately after having been repaired. The idea is simple, given a choice between two vehicles, one that has been in a serious collision and another which has not, buyers will invariably choose the vehicle without a collision history. No matter how well a car has been repaired, it’s invariably worth less than before the collision.

Proving Diminished Value damages generally requires hiring an appraiser to determine a vehicle’s Fair Market Value before the accident and immediately after repairs have been completed. While the trend is slowly changing, you can expect insurance companies to aggressively deny diminished value damages, falsely claiming they’re not recoverable in California or a vehicle must first be sold to determine damages.

View the official Jury Instruction for Diminished Value

Loss of Use is also an important item of damages in California. Damages for loss of use are calculated by what a similar car to yours would rent for during the time reasonably necessary to repair or replace a vehicle following an accident.

Damages for Loss of Use can be significant. Most new, luxury or exotic cars are expensive to rent. Repairing these vehicles may take weeks or months to complete. It’s not unusual for a high-end vehicle to rent for $1,000 or more per day. If repairs take sixty days, the Loss of Use would be $60,000.

View the official Jury Instruction for Loss of Use

Were You Injured in Your Accident?

The team at Kerr & Sheldon Law are experienced in personal injuries and are ready to help you not only with your diminished vehicle value, but with any personal injury you might have sustained. If you’ve been in a car accident, the personal injury attorneys have over 40 years of experience to assist you with your case. Contact us today for further assistance.

Diminished Value Settlements

The legal team at Kerr & Sheldon have worked on previous cases for diminished values. The table provided below displays examples of cases that Kerr & Sheldon have worked on previously. Don’t let the value of your vehicle go to waste. Get the value you are owed with our help!

FAQ

What is “Diminished Value”?

The accident history of a car involved in a collision significantly decreases its value and often presents safety issues. This decreased value is called “Diminished Value,” and occurs because most people won’t buy a vehicle that has been in an accident without a significant price discount. Diminished Value is the difference between the market value of a car prior to a collision and its reduced value following an accident and subsequent repair. At Kerr & Sheldon, we provide a free diminished value evaluation.

How is Diminished Value calculated?

If a vehicle has lost value due to an accident, the owner is entitled to (1) the difference between its value before the accident and its lesser value after repairs and (2) the reasonable cost of repairs. However, the total amount recovered cannot exceed the vehicle’s value before the accident occurred.

How do I prove how much my vehicle has lost in value?

If you’ve already sold your car, the decreased sales price is proof of the loss. If you still own the vehicle, it’s necessary to hire a reputable appraiser to assess the likely loss in value.

Read More

Can I recover Diminished Value for a leased vehicle?

Diminished Value cannot be recovered for a leased vehicle in California unless the leasing company charges you a damage fee due to the accident.

How much can you recover for Loss of Use damages?

Damages for Loss of Use can be significant. Most new, luxury or exotic cars, trucks or RV’s rent for hundreds of dollars a day. Repairing these vehicles can take weeks or more to complete. For example, a Ferrari’s comparable rent is about $1,000 per day. If repairs took thirty days to complete, the Ferrari’s Loss of Use would be $30,000.

Insurers often provide lesser quality rental cars as a substitute. Don’t be fooled; unless it’s a comparable rental vehicle, you’re still entitled to Loss of Use less a credit for whatever the insurer paid for the economy rental.

Which is Better: Loss of Use or Rental Reimbursement?

That depends on whether you have other transportation available. If you need a car for work or getting the kids to school, etc., then renting a comparable car to your own and requesting rental reimbursement is a better option. On the other hand, if you don’t need a replacement car, then Loss of Use is a better option because you’re being paid for the rental value of your damaged car. Loss of Use is a significant, and often overlooked, aspect of property damage in most car accidents.

What are Common Mistakes People Make in Loss of Use Cases?

The main pitfall in collecting reimbursement for Loss of Use and Rental Car Reimbursement is delayed in getting the car inspected and repaired promptly. You have a duty to ‘mitigate your damages,’ which essentially means insurance companies are not obligated to pay for any delays you cause in getting your car inspected or repaired.

Can I recover Diminished Value from my own insurance company Diminished Value cannot be recovered against your own insurance company in California. It can only be recovered against the insurance company of the negligent party who caused the accident.

What Can I Expect My Insurance Company to Pay While My Car is Being Repaired?

If your car is damaged in an accident and you have rental car insurance, your coverage is usually limited by a daily rate (e.g. $30 per day) and by the number of days a rental car is available (e.g. 20 days). Some rental coverage provides for Loss of Use as an alternative to renting a car, but again, coverage is limited by the terms of your insurance contract.

How is the Amount of Loss of Use Determined?

The best way to determine the rental value of a comparable vehicle is to go online and check the prices of rental car companies with similar vehicles to yours for rent. Save and print the price quotes you find, as these can be used to prove the reasonable per diem rental cost of your damaged vehicle. The next step is to multiply the per diem rate times the number of days reasonably necessary to repair your automobile.

Damages for Loss of Use can be significant. New, luxury, or exotic cars, trucks, and RV’s can rent for hundreds of dollars a day. Repairing these vehicles can take weeks and sometimes months to complete. If a vehicle’s comparable rent is $100 per day and repairs take thirty days, then Loss of Use would be $3,000.

What is “Loss of Use” and why is it important?

If your vehicle has been damaged or totaled in an accident, you’re entitled to recover Loss of Use damages from the responsible driver’s insurer. Loss of Use claims are often made in conjunction with Diminished Value claims, but can also be pursued separately.

An owner is entitled to recover the Loss of Use of their vehicle from when the vehicle is wrecked until it’s repaired or settled as a total loss. Damages are determined by the reasonable cost to rent a similar vehicle for the amount of time reasonably necessary to repair or replace the vehicle.

What Can I Expect to be Paid From the At-Fault Driver’s Insurance Company?

You’re entitled to recover either Loss of Use or rental car reimbursement from the at-fault driver’s insurance, which is not limited by a contractual daily rental rate or duration. You can make a claim against the at-fault driver’s insurance for the cost to rent a similar vehicle for the time reasonably necessary to repair your automobile.

If my insurance provides a rental car of lesser value, can I still request Loss of Use from the at-fault driver’s insurance company?

If your insurer provides a lesser quality rental car as a substitute, you’re still entitled to claim the Loss of Use of a comparable vehicle against the at-fault driver’s insurer (less the cost of the lesser quality rental car).